Indonesia and Australia's Bilateral Relationship- Unlocking Mutual Opportunities

The bilateral relationship between Indonesia and Australia has been a hot topic in the last few months. With the relationship moving from strength to strength, our article highlights some of the challenges and opportunities that lay ahead.

Current bilateral relationship

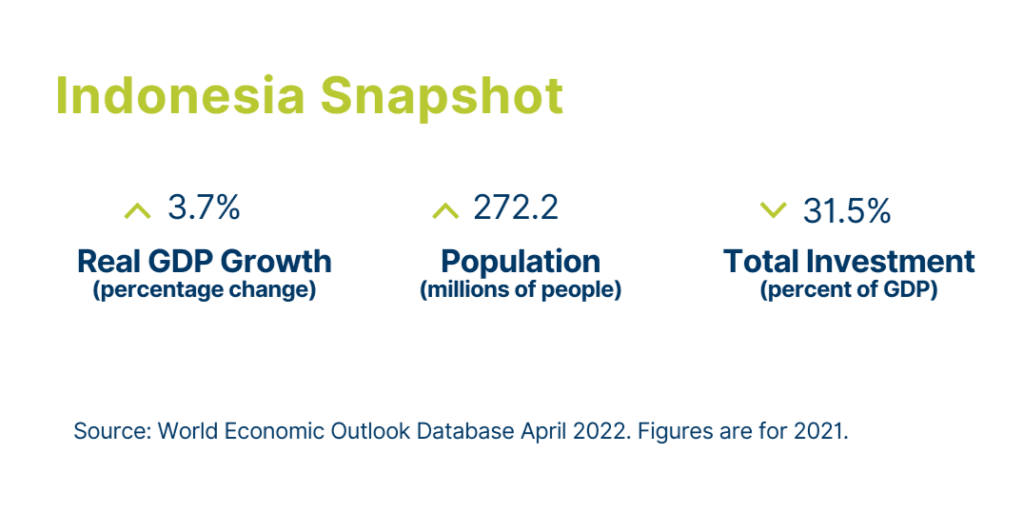

Indonesia boasts a vibrant, entrepreneurial, and digitally literate young and emerging population, who are already a formidable engine of purchasing power and creativity. As the de-facto leader of ASEAN, Indonesia is positioned to play an influential role in Southeast Asia’s security and economic prosperity. By 2050 Indonesia is predicted to have a population of well over 300 million and will be the fourth largest economy in the world.

Indonesia is a strategically significant partner for Australia; strengthening bilateral ties complements and supports a shared interest in fostering a secure and mutually prosperous region. The ratification of the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA) in 2020 and the Regional Comprehensive Economic Partnership (RCEP) means both nations have favourable trade mechanisms to drive economic integration.

Unfortunately, despite these trade agreements, the bilateral relationship is yet to reach its full strategic and economic potential. Prime Minister Albanese’s first international visit to Indonesia represented his desire to rekindle and intensify the bilateral relationship under his government. From an Indonesian perspective, Australia is viewed as the partner of choice over other nations due to the values and procedures inherent in Australian business practices.

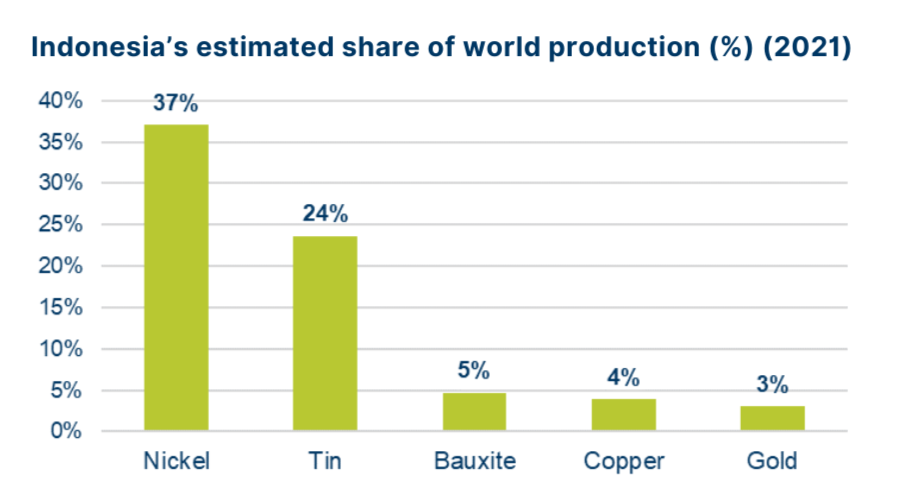

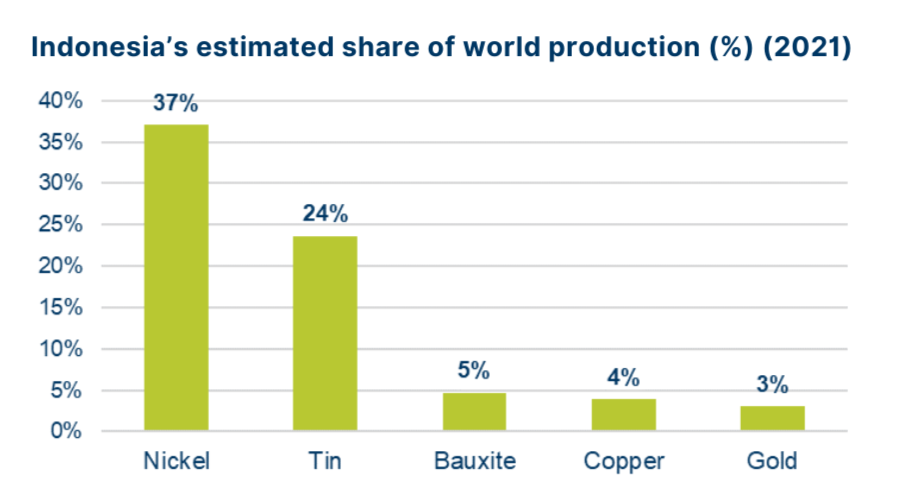

Like Australia, Indonesia has been a sustained player in the global resource industry. Indonesia is well-endowed with coal, copper, gold, tin, bauxite, and nickel. Australia has the products and technical expertise to improve the efficiency and sustainability of Indonesia’s resources and energy sector. In return, Australia could access Indonesia’s youthful workforce, who can drive further innovation on existing products or create new technologies. Indonesia’s human capital stocks are becoming more advanced and sophisticated as the level of education rises.

Source: Mineral Commodity Summaries 2022, by: U.S. Geological Survey

Challenges faced by Australian companies in Indonesia

Due to the challenging and fluid regulatory environment, Australian mining companies often consider Indonesia a risky and complex market. The market conditions mean barriers to entry for Australian mining companies are extremely high. International miners, such as Newcrest, Rio Tinto and BHP, have divested from the Indonesian market over the last 20 years.

Current challenges include:

- The 2020 Mining Law amendment revised divestment rules and specified gradual divestment of 51% with no fixed timeline. Uncertainties surrounding divestment timelines affect a mining company’s ability to accurately calculate its return on investment, leaving them vulnerable to losses.

- Overlapping of permits by different ministries. Companies incur additional costs and delays due to the overlap of permits, which reduces profitability.

- The structure of the mining industry is highly consolidated; state-owned enterprises dominate the Indonesian mining industry.

Despite these challenges, Indonesia is home to some of the most profitable mining operations in the world- businesses may be able to price the risk into their operations.

Why Australian companies should focus on the EETS sector

Given the market and regulatory structure, the most streamlined way to access the Indonesian market for Australian companies lie in the Equipment, Engineering and Technology Services (EETS) across the resources and energy sectors. The EETS sector is a natural extension of the Mining Equipment, Technology and Services (METS) industry, which has been identified as a priority sector by the Australian government. Australian companies have preferential trade mechanisms through reduced tariffs due to IA-CEPA. Its estimated that over 140 Australian METS companies are active in the Indonesian market.

An advantage of investing in the Indonesian EETS sector, compared with direct investment in mining assets, lies in the reduced CAPEX requirements which subsequently reduces the risk faced by firms. Most costs associated with the EETS sector stem from accumulated investment in IP development, which can be deployed globally, and from ongoing operational staff costs which are attractive in Indonesian. Additionally, the sector takes advantage of Australians’ abilities and expertise in developing and deploying human capital.

Indonesia is ambitiously pursuing a push towards downstream processing and refining. Coupled with a drive to improve environmental standards and efficiency, opportunities are emerging for the Australian EETS sector in Indonesia. The opportunity arises from Australia’s ability to inject its technological and technical expertise. However, Australian companies need to focus on adapting their technology to suit the requirements and needs of Indonesian clients.

There is an opportunity for mutual learning between Australian and Indonesian EETS companies – it’s not all one-sided. The development of further cooperation in the EETS sector will build on the current immature business climate and drive economic integration. The Australia-Indonesia relationship has not yet reached its full potential, but substantial opportunities exist to collaborate within the resources and energy sectors.

If you are keen to continue the discussion about Indonesia and Australia’s bilateral relationship, reach out at contact@stateofplay.org.