Mining’s potential blind spot: undervaluing Asia’s influence on innovation

The intrinsic link between economic development and the mining industry

Throughout history, we have seen an intrinsic link arise between the rate of economic development in emerging nations and the cyclical nature of the commodities industries. This has been particularly true for the impact of Asian development on the neighbouring Australian mining industry. In the 1960s, the economic development of Japan boosted global demand (and prices) for resources, encouraging mineral discoveries and a six-fold increase in Australian mining investment. In the mid-2000s, China’s emerging economy drove year-on-year increases in steel demand, causing iron ore prices to increase dramatically from around US $16/tonne in the early 2000s to an all-time high of US $191/tonne in 2011, fuelling an Australian mining boom.

Natural resources are needed to build everything from cities and ships to cell phones and solar panels, so we can expect this inextricable link between economic growth and mining markets to continue, now driven by both industrial and technological progress. For example, the rising demand for batteries for the energy transition is encouraging strong growth in the lithium sector – and calling for innovation in mining processes to meet the unique supply requirements of these advanced products. Technological progress itself drives mining innovation, providing tools like automation and machine learning to solve increasingly complex problems in the supply chain of natural resources. As developing Asian nations are both dominating high-impact research across the majority of critical and emerging technology domains and are forecast to enjoy an average 4.8% GDP growth in 2024 (1.9 percentage points higher than the global average, and over 3 percentage points higher than the US/Euro area), it is entirely likely that these markets will continue to exert a strong influence on the mining sector.

Mining industry’s perceptions of Asian economic development

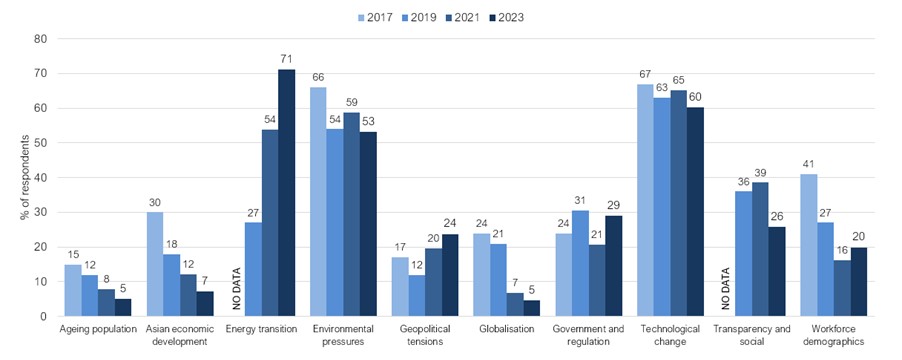

Which of the following global trends will have the biggest impact on mining innovation over the next 15 years?

Figure 1: Respondents given 3 answers.

Despite this, our 2023 Mining Industry Survey finds that the mining community has significantly downgraded its view of Asian economic development as an important driver of innovation (Figure 1). In 2023, only 7% of survey respondents selected Asian economic development in their top three impactful trends on mining innovation – effectively ranking it 8th out of the 10 trends considered. Back in 2017, it was ranked 4th, with nearly a third of survey respondents considering it a trend of leading importance.

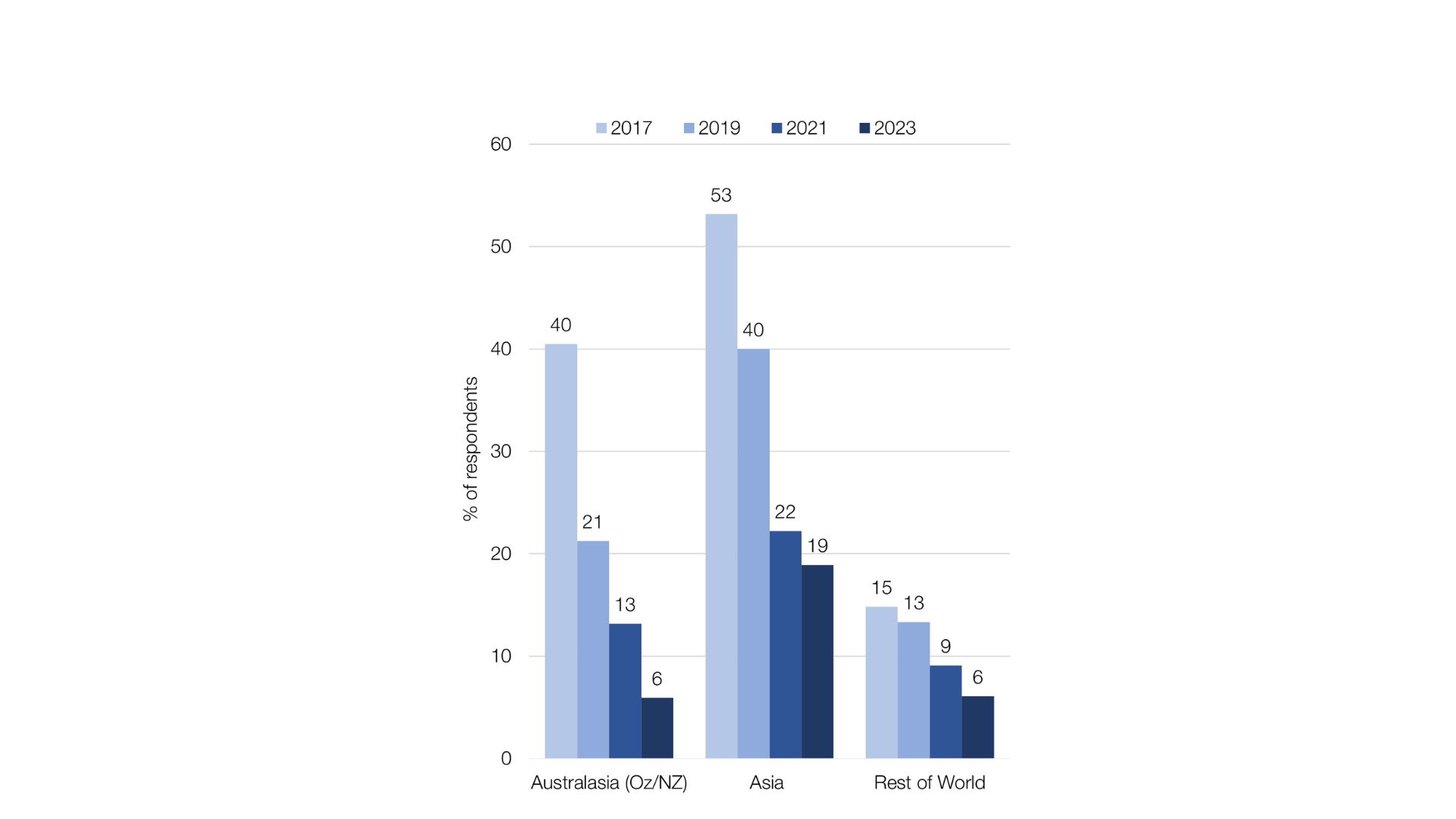

While the growing importance of the energy transition may have diverted some attention away from the significance of Asia, this effect alone is not enough to explain their low ranking. Nor is this issue of perception isolated to the West – though a higher percentage of survey respondents from Asia ranked Asian economic development as a top-three trend in 2023 (19%), this group has still exhibited a stark drop from 2017 (53%, Figure 2).

How did respondents from each region rank Asian Economic Development as a top-3 global trend to influence mining innovation?

Figure 2

The realities behind the perception problem

All of this is occurring in the midst of a huge rise in the middle class of Asia, which will go on to dominate the number of global university graduates (meanwhile, mining engineering enrolments in Australia and the United States are plummeting). Couple this with the positive public perceptions of mining (with many attributing the sector to assisting the growth in standard of living), throw in leading consumer demand for modern mining products like electric vehicles (the majority of which are made in China), and you have all the makings of a powerful incubator for mining innovation. The effects of this have already been displayed. China’s dominance in automation and digital technology has seen it submit thousands of AI public patents, and it’s also leading the energy transition as the world’s largest and fastest-growing producer of renewable power. It has operated 5G-powered no-entry smart mines for years, improving production, emissions, and safety outcomes. These pockets of potential innovation are found all across Asia: Japan is taking the lead in “urban mining”, South Korean miners are investing heavily in research and startups, Indonesia is rapidly developing its downstream nickel capabilities, and Vietnam has a growing number of state-of-the-art mining and processing operations.

So, why the waning perception of Asian economic influence in mining innovation?

A recent rise in geopolitical tensions (not to mention the COVID-19 pandemic) has spurred a continuous stream of bad press in the West, for China in particular. This tension has resulted in a host of back-and-forth political and policy actions, and has seen investors from both sides withdraw investment due to perceived risks (foreign direct investment in China has fallen by over US $100 billion since the beginning of 2022). Recent actions by North American and Australian governments have further excluded Chinese entities from incentive programs, charged them a premium, or prevented them from investing entirely. More widespread incidents of hostility between the East and West include punitive restrictions on imports and exports, disruptions in mineral supply chains, and even instances of spying and military engagements. These events have significantly eroded international trust and cooperation across the Asia-Pacific – but even so, China and Australia remain key trading partners, and political messaging may be blinding mining industry players to the realities of the complex, interconnected resources pipeline.

“I think we just need to be less possessive about some of this stuff and get a little more cooperative and collaborative… I believe China has cracked the code when it comes to critical mineral processing. They could bring that to Australia… If there’s the ability to do processing in Australia, bring that IP into Australia, and bring the investment money in, it would be great for the Australian critical minerals industry.”

Mining Industry Expert

The rising importance of certain critical minerals has positioned some Asian nations as commodity powerhouses, particularly in the face of the looming energy transition. Developing countries such as Indonesia have suddenly emerged as the dominant supplier of minerals critical to the energy transition, such as nickel. Indonesia is on track to being one of the world’s ten largest economies by the mid-2030s and the fourth largest economy by mid-century. This is largely driven by a rising middle class, a growing population (now the fourth largest in the world) and digitalisation, which are all changing the landscape of business in Indonesia. A focus on education by the government will no doubt assist in the country’s ambitions to be a key player in the global EV supply chain. Whilst many see the rising importance of countries such as Indonesia, it is recognised that the relationship between Australia and Indonesia has never realised its true potential (Indonesia makes up less than 2% of Australia’s international trading, despite its relative proximity and economy). It may be a case that the true impact that developing Asian countries could have on innovation and the global mining industry is currently being overlooked.

Potential costs of this perception problem

There is a vast opportunity cost of the mining industry’s cooling attitude towards Asia. In the last mining boom, the industry was predicted to miss out on about US $20 billion1 due to its slow response to rising Asian demand for commodities, despite the growth being predicted by shipping companies years earlier. History may repeat itself here: given the short adoption timescales offered by digital innovation, these shifting perceptions could very quickly see foregone profits surge as conventional mining businesses fall behind tech leaders in Asia. Conversely, companies that adapt their strategies to cater to the specific conditions of Asian economies are well poised to embrace any emerging innovation and position themselves as industry first-movers.

The mining industry’s blind spot also obscures the vast investment opportunities that lie within developing Asian markets. As governments and private enterprises in the region seek to secure a stable supply of critical resources, there is a growing need for investments in exploration, extraction, and processing technologies. Ignoring those opportunities may once again result in foregoing healthy future profits. This sword cuts both ways; discouraging Chinese investment will require nations to instead shore up project funding from other sources – a tricky feat in the mining industry right now, given the current global economic struggles and a preference for ESG projects in financing. Meanwhile, China is directing investments into competing resource regions (such as Africa and South America), and deploying innovative technologies there.

“Australia became the sovereign risk [for China], which is quite remarkable.”

Mining Industry Expert

Conclusion

Collaborative efforts between mining companies, technology providers, investors, and governments could pave the way for the adoption of state-of-the-art smart mining practices, offering a step-change in innovation backed by skills and demand from a growing population of the Asian middle class. But whatever the reason, attention (and more importantly, investments) have shifted away from what may well be a burgeoning centre of mining development in Asia.

Without a crystal ball, it’s impossible to predict the pivotal drivers of innovation over the next fifteen years. Perhaps the industry is on the money here: a reshuffling of global alliances and metals supply chains could feasibly be a raging success; the energy transition, environmental concerns, and technological revolution may drive real mining innovation far more than any other trend; and the development of the global mining industry may cease to correlate with the development of the globe’s largest region. But perhaps not. And given the US $20 billion price tag of the mining industry’s last oversight, perhaps Asia might be worth another look…

Read more about the data underpinning this article and many other insights in our 2023 Mining Industry Survey, available early next year.

- Slate analysis – refers to miners’ inability to supply resources through ramp-up in the mid-2000s. ↩︎