From coins to cars

From armor to cutlery and coinage to pieces of art, nickel has historically had a range of valuable uses. Fast forward a few hundred years, and the race to green energy has seen nickel become a major component in electric vehicles (EVs). As the world grapples with how to address the energy transition, the rise of the importance of battery minerals has put them on a volatile cycle, as price reacts to supply constraints and EV demand. More recently, the market was caught off guard by an influx of cheap nickel supply from Indonesia, driven by Chinese investment in H-PAL technology, leading to a 50% fall in nickel prices over the past 12 months. The Australian resource industry hasn’t been able to compete, with mining companies shutting down mine operations, resulting in over 1600 job losses.

Whilst there was no way for companies to see this exact situation take place, it’s not surprising that technological advancements would allow certain countries to be able to produce greater quantities of cheap nickel. Scenario planning in the mining industry isn’t a new phenomenon, it has been used for decades to help companies determine the viability of their mine sites and develop risk management strategies. This leave us with the question- how did the industry miss the price drop?

History is the best teacher…but are we good students?

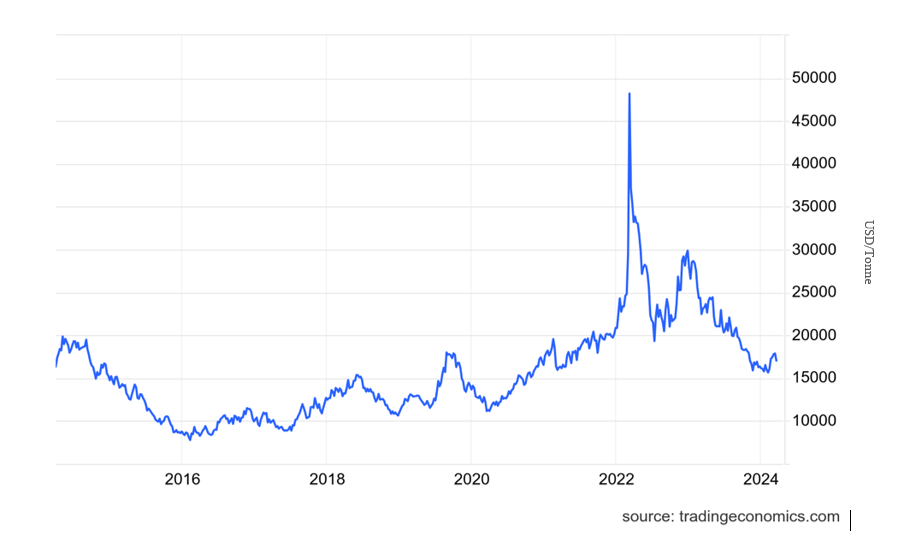

As the world came to a halt during the pandemic, demand for nickel plummeted, triggering a decline in prices. Then, the Russia-Ukraine war sent shockwaves through supply chains, leading to soaring nickel prices (Figure 1). These past events have served as reminders of the volatile nature of resource markets, underscoring the need to address the ‘what ifs.’ What if there’s a drop in the prices of other critical minerals? What if the Australian government introduces policies to support domestic battery production? What if green premiums materialize? This is where scenario planning proves valuable – a process of visualizing and analyzing multiple possible future outcomes based on different assumptions and variables.

Nickel prices over the years

Figure 1

Given the volatility witnessed in the nickel market and the ever-evolving landscape shaped by macro-economic, technological, political, and social factors, it is imperative for Australian mining companies to prioritise robust scenario planning. This essential tool serves as a guard against bias, ensuring that project outcomes are not skewed unreasonably by anchoring on overly optimistic or conservative futures.. The development of scenarios involves two fundamental schools of thought – creativity and plausibility. It begins with brainstorming about how the world could possibly look and analysing the external environment to identify key variables. These scenarios are then structured to include a range of potential outcomes, reflecting both optimistic and pessimistic perspectives. Effective scenarios go beyond just storytelling, they’re data-driven and challenge conventional thinking but are always grounded in logic. Ultimately, the goal is to develop strategies that maximise results while mitigating risks by identifying key drivers of change and increasing clarity.

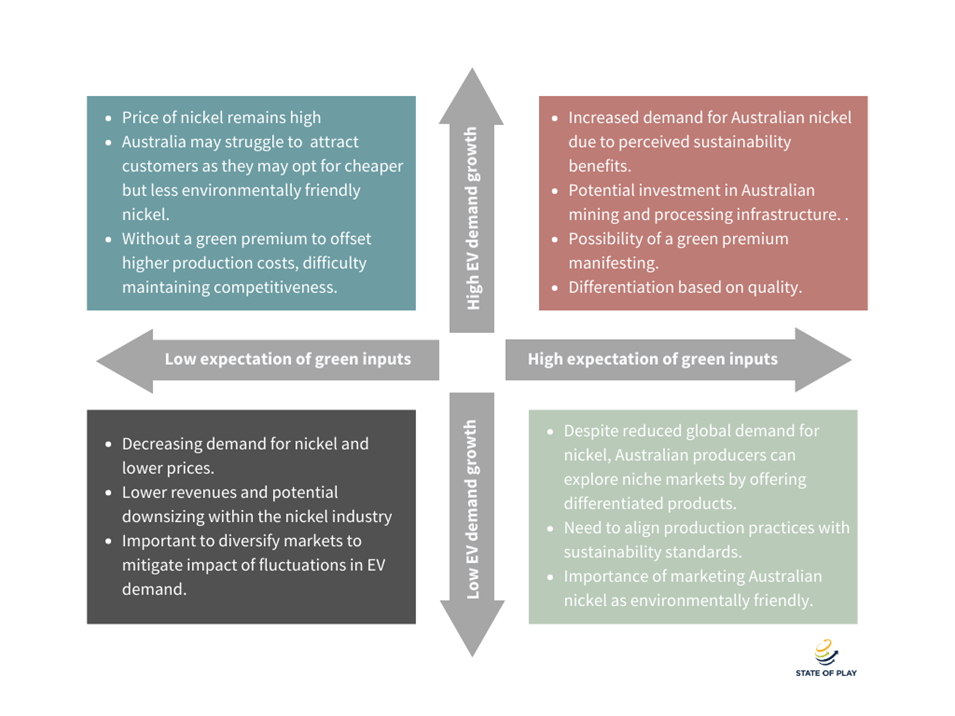

The nickel market, in particular, is affected by a multitude of factors including geopolitical tensions, technological advancements, demand for EVs and stainless steel, and the broader macroeconomic climate. Figure 2 below provides simplified examples of demand driven nickel scenarios that we have explored. While it offers a glimpse into possible futures, it’s important to acknowledge that there are plenty of other variables to consider.

Figure 2

Lessons learned: Become comfortable with uncertainty

One key takeaway from the nickel supply glut is that things happen: export bans get lifted, forecasts go wrong, and prices plummet. However, the true measure of resilience is our response to these roadblocks. Will we learn from them and adopt a proactive approach moving forward? Can we leverage technological advancements and human intuition to refine our strategic planning processes? Moreover, do we advocate for support for stakeholders who were adversely affected by this such as workers in the Australian mining sector who lost their jobs? Now is the time for companies to not only reflect on their strategies but also establish robust mechanisms such as risk management frameworks and contingency plans for various scenarios.