Unearthing Innovation: Advancements in exploration technologies

In the face of depleting surface resources, mining companies are confronted with the challenge of either venturing into increasingly remote and complex areas or exploring deeper beneath the surface.

Traditional techniques such as geological mapping, geochemical analysis, and geophysical surveys have proven effective in uncovering potential mineral resources near the earth’s surface. However, the deeper the target, the greater complexity there is in analysing the composition and structure of the rocks. In 2019, it was estimated that 43% of hard-rock mines (excluding China and the Middle East) were underground, highlighting the growing importance of exploring and mining at greater depths to meet the increasing global demand for minerals. A step-change in existing methodologies, or the development of new technology is required if companies wish to be successful within this new frontier.

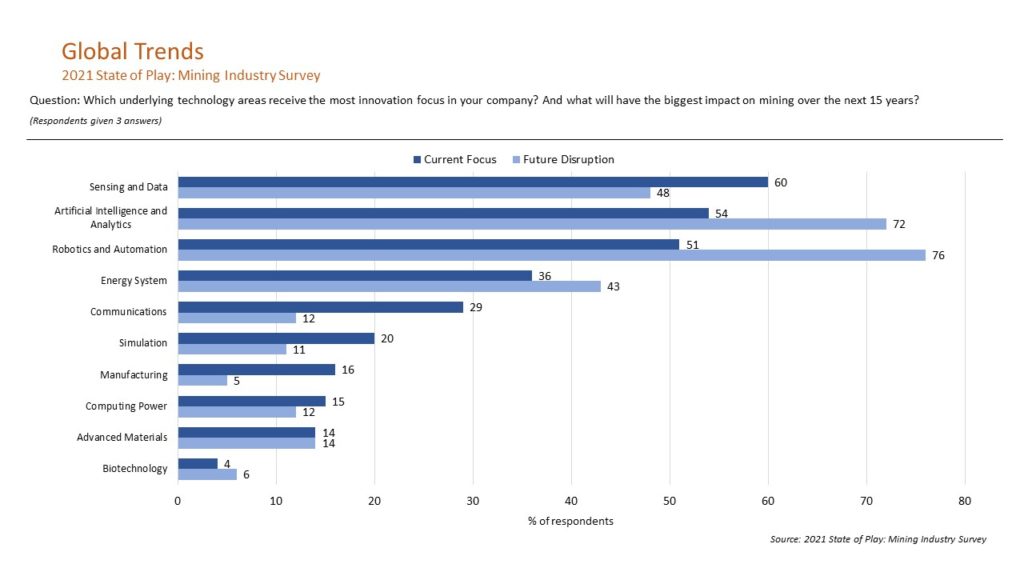

In response, the mining industry has been focusing on the development and integration of innovative technologies, including artificial intelligence (AI), to improve ground selection, as well as geophysical solutions for more effective subsurface mining. Our 2021 Mining Industry Survey supports this, highlighting sensing and data, artificial intelligence and analytics as both the likely sources of future disruption to the industry, as well as the current focus of companies’ innovations efforts. Given that the mining industry now spends 3x more money to make 60% fewer discoveries than 30 years ago, the demand for new technology applications is completely justified.

The role of AI in ground selection

With the vast majority of ‘easy to find’ surface ore bodies having already been discovered, the mining industry is being forced to look in areas where rock signatures are less obvious and geophysical interpretation is more difficult. The current solution is to drill more holes. This allows companies to define orebodies more efficiently. The only caveat to this (besides the cost of drilling), is knowing where exactly to drill the holes in the first place, thus increasing the emphasis on ground selection and definition techniques.

In response, the mining industry is leveraging the power of AI to analyse and interpret geological data in order to improve ground selection. When built and trained appropriately, machine learning algorithms can process large and complex data sets and identify patterns and anomalies that may indicate the presence of mineral resources.

To develop AI solutions successfully, companies will have to overcome some barriers. Whilst there is some publicly available information, the competitive nature of exploration combined with years of poor collection and storage practices has led to a lack of quality historical data to train machine learning algorithms on. Without the ability for the models to continuously learn and refine their own algorithms, there will be a reliance on human expertise. This may lead to human biases and means the models could be limited by the conceptual understanding of the expert involved.

Despite the challenges, several companies have already started the journey of developing AI solutions to enhance ground selection. GoldSpot, KoBold Metals, Koan analytics and SenseOre are all examples of emerging players that aggregate geophysical data and apply AI to identify exploration targets. Each of these companies have different technology approaches, however there is a common process. That is, they can aggregate all publicly available mineral resource data, integrate it with a mining companies exploration data to create a knowledge repository, and then apply proprietary algorithms to analyse and identify potential exploration targets.

The business models employed vary between companies. Given that majority of prospective land is already ‘pegged’, the interplay between landowners and technology providers is a critical component. A common approach is through joint venture, however as these technologies mature and the AI solutions become more reliable in ground selection, we may see this shift further towards productisation.

Exploring deeper with geophysics

With AI informing ground selection, the next phase of advancement in exploration lies in ground definition. There is an array of new ground penetrating technologies and geophysical techniques that have the potential to drastically improve the economics and accuracy of exploration at depth through the improvement of ground definition.

The objective of these technologies is to be able to understand what is under the surface without having to drill a hole. Current geochemistry, electromagnetic and gravity sensing methods are efficient within 200-300 metres depth from the surface, however beyond this the signals these technologies provide become harder to translate and interpret. The current hypothesis is that beyond 300 metres, geophysical methods are the most promising.

Some examples include mounting existing technology to flying drones, improving existing sensors and probes, all which allow for high resolution imaging and improved data gathering to feed geophysical models. Another promising geophysical approach uses seismic techniques to aid in the precise location of drilling sites once the ground has been selected. Despite the oil and gas industry employing seismic technology since the early 1900’s, it is still in the very early stages of adoption within the mining industry.

A small number of companies, including HiSies, are actively developing and commercialising seismic mining technology. As it stands today, the implementation remains costly, and its performance can vary. Subsequently, its adoption has primarily occurred within brownfields expansion projects where the ground selection risk is minimal, and by larger mining companies with greater access to capital to fund its use.

Greater research and development (R&D) is required to bring costs down and improve the accuracy of geophysical technology. The MinEx Co-operative research centre, CSIRO, universities and mining companies are all actively investing in the space, however there is still a long road to commercial readiness and adoption.

Market segmentation – A barrier to implementation

The upstream portion of the mining value chain is highly segmented, with different companies handling prospecting, exploration, development, and operations. Major miners have largely exited the exploration space and outsourced the discovery process to junior companies, who rely on private or public investment to cover their expenses and hope for a payoff through a major discovery or buyout. These junior miners, constrained by tight budgets and strict rules (JORC), have little to no capital reserves to spend on low TRL methods for exploration. As a result, innovation in the exploration segment of the mining industry has suffered over the last 60 years.

As it stands today, there are little incentives in place for the application or demonstration of new technology, with the relationship between the explorers and the operators highly transactional. If the industry wants to improve greenfield exploration, the varying players are going to need to be more cooperative. If those with the expertise in exploration can leverage the large balance sheets of the miners who prefer to operate, there will be a greater appetite and incentive to apply and adopt new and innovative approaches.

As mining companies continue to face resource depletion on the surface, the industry is diligently working towards developing advanced technologies to improve ground selection and mining at depth. The integration of AI and the continued progress of geophysical technologies hold great potential for revolutionising exploration practices, reducing costs, and enhancing the overall efficiency of mining operations. With ongoing research and development efforts, and the application of new cooperative models between explorers and operators, the mining industry aims to unlock the full potential of these technologies, ensuring a sustainable and profitable future for mining operations worldwide.