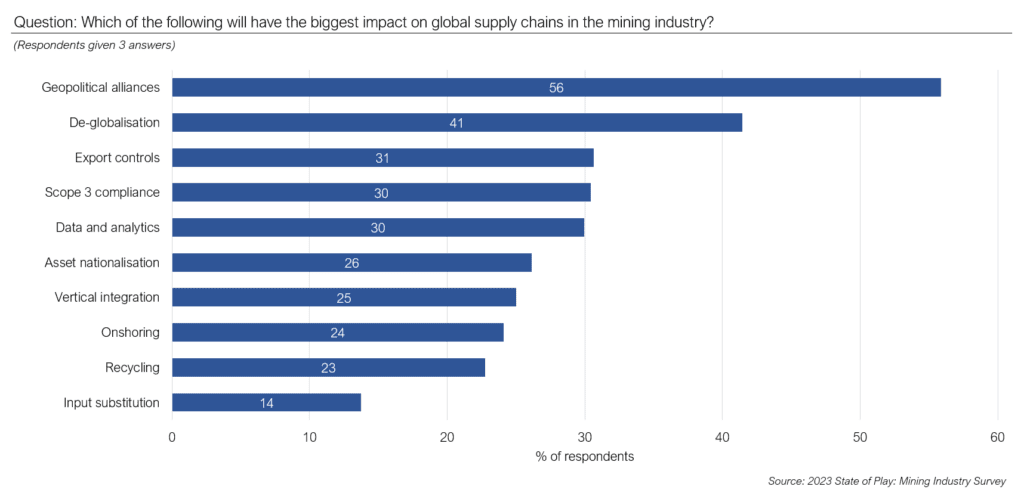

In recent years, industry has been grappling with declining ore grades, depletion of known deposits and rapidly increasing demand for critical minerals to fuel the transition to net zero. Consequently, nations and companies have invested heavily in shoring up their supply chains. This is particularly true for critical minerals, where geopolitical dominance across some areas of the supply chain has created heavy reliance on certain countries. It is no surprise 56% of industry believes geopolitical alliances will have the biggest impact on global supply chains in the mining industry over the next 15 years.

Various countries dominate the extraction of critical minerals. The Democratic Republic of Congo (DRC) is responsible for approximately 70% of global cobalt supply, while Australia (approximately 55% of global lithium supply), Indonesia (currently 39% global nickel production – expected to increase to 75% from 2029), and China (70% of global rare earths extraction) dominate the extraction of other minerals. Likewise, midstream and downstream processing of critical minerals is almost exclusively dominated by China, who are responsible for 80% of lithium hydroxide supply and 70% of cobalt refinement. This is despite China containing only 8% and 3% of global lithium and cobalt reserves respectively.

In Australia and other countries, there has been a significant push to invest and establish downstream processing capabilities to counter-balance current Chinese supply chain concentration and shift away from the ‘dig and ship’ approach. Thus far, movement has been relatively slow within Australia, while projects based overseas have faced similar issues with licensing and regulatory approvals, such as Lynas’ Rare Earth plant in Malaysia.

Similarly, countries are aiming to scale up their own production within country or through investments in other countries. However, the timeframe to get new projects online is long (approximately 15 years) and the shortage of mineral supply is likely to get worse in the interim. This is further exacerbated by a shift to exploration and extraction in geopolitically unstable regions to address declining orebody quality and known deposits, which face jurisdictional risk issues and ESG pressures.

Trade tensions have further highlighted supply instability, with critical minerals trade, particularly in minerals important to defence, AI and advanced computing technologies, becoming politicised. Sudden restrictions of export of gallium and germanium, of which China accounts for 94% and 60% of global production respectively, in response to American and European trade restrictions has resulted in a 40% and 9% increase in gallium and germanium ingot prices respectively and is forcing companies to turn to alternative stockpiles which are limited. Trade tensions along with the Russian invasion of Ukraine, has highlighted the fragility of many countries’ supply chains in the face of geopolitical instability.

A shift to strengthen geopolitical alliances

This myriad of issues has underpinned the shift to nations shoring up their supply chains and strengthening their geopolitical alliances. Significant policy movement has occurred over the past 3 years, to develop partnerships and promote investment in alternative regions to secure both supply and processing of critical minerals. Recent policy movement includes:

- The US Department of Energy and Defence have both contributed significant amounts of funding to Australian companies with processing facilities in the US, including Syrah Resources and Lynas Rare Earths.

- The U.S.-Japan Critical Minerals Agreement enables access to incentives under the IRA. Australia is also able to access this under an existing free-trade agreement.

- The proposed EU Critical Raw Materials Act aims reduce sole dependence on some countries for minerals and mandates a 10% increase in EU supply, and further increases in recycling and processing.

- A proposed €2 billion German state fund to support mining of raw materials and critical mineral alliance with Australia.

- South Korean measures to ensure critical mineral supply, include forming strong diplomatic relationships with resource-rich nations and the development of Minerals Security Partnerships (MSPs) to assist domestic companies in overseas investment.

Ensuring that countries have strong geopolitical alliances in place will be a crucial determinant of access for minerals vital in the race to net-zero. Equally so, geopolitical alliances will be imperative for companies looking to take advantage of this unprecedented investment.