The viability of downstream processing within Australia continues to be a highly debated topic within government and industry. Despite supplying 60% of the world’s lithium, analysis suggests Australia currently earns only 0.5% of the ultimate value of its exported ore. If the global market for the entire battery chain reaches the forecasted $400 billion by 2030, Australia could be foregoing billions of dollars of economic opportunity by not moving downstream.

A shift into downstream production of batteries also has the potential to underpin a domestic battery recycling industry and presents Australia with a unique opportunity to be one of the only nations that can do the full value chain- from digging through to reuse. Given the unpredictable nature of commodity output, as well as surging prices for battery minerals, establishing a secondary market for recycled batteries would also bring stability to a supply chain that has experienced significant disruption over the last few years.

According to CSIRO, only 10% of Australia’s lithium-ion battery waste was recycled in 2021, with the rest either ending up in mixed landfill domestically, posing significant fire and explosion risk, or being shipped abroad under strict export conditions for further processing. In addition to the environmental and safety concerns surrounding battery waste transport, there is also an economic cost from not recycling them domestically. Its estimated that the lost value associated with the battery metals and materials recycled from lithium-ion batteries could be as large as $3.1 billion.

Instead, by establishing a battery production and recycling value chain, Australia can capitalise on a rapidly expanding global market. The entire global battery chain could grow by over 30% annually from 2022 to 2030, and up to 18 million new and existing jobs could be created. Australia is uniquely positioned to deliver – we have an abundance of renewable energy to power the facilities, a world leading mining ecosystem to leverage and a skilled workforce. So, what is needed to get a domestic battery industry up and running?

What’s required?

Capability

Australia’s pursuit of a viable battery recycling industry is not an unrealistic goal. As a mining nation, we have existing knowledge and technical capabilities in hydro and pyrometallurgy, which are directly applicable to several battery recycling processes. By leveraging such capability, companies such as Envirostream have already achieved commercial progress. The Melbourne based company use a combination of mechanical and hydraulic separation techniques, recovering around 95% of the materials that make up a battery.

Investing in the skills and training required for a recycling industry will also be critical to its success. According to a report by the Future Battery Industries CRC, gaps have been identified in existing training to cover skills and knowledge specific to lithium-ion battery recycling processes. These gaps include the safe removal, handling and storage of lithium-ion batteries, as well as disassembly, shredding and mechanical separation processes.

Investment and Policy

Significant investment from both the public and private sector will be required to develop a viable recycling industry. The initial set up costs for a facility are often large, not to mention the risk associated with investing in a new industry. Transportation costs alone can contribute, on average, 41% of the total cost of recycling, meaning co-location of facilities with primary mineral and chemical refineries can create efficiencies. Australian company Neometals finalised the capital cost estimates for its first proposed lithium ion battery recycling plant in Germany in 2021 at an estimate of US$165 million, demonstrating the substantial funding required.

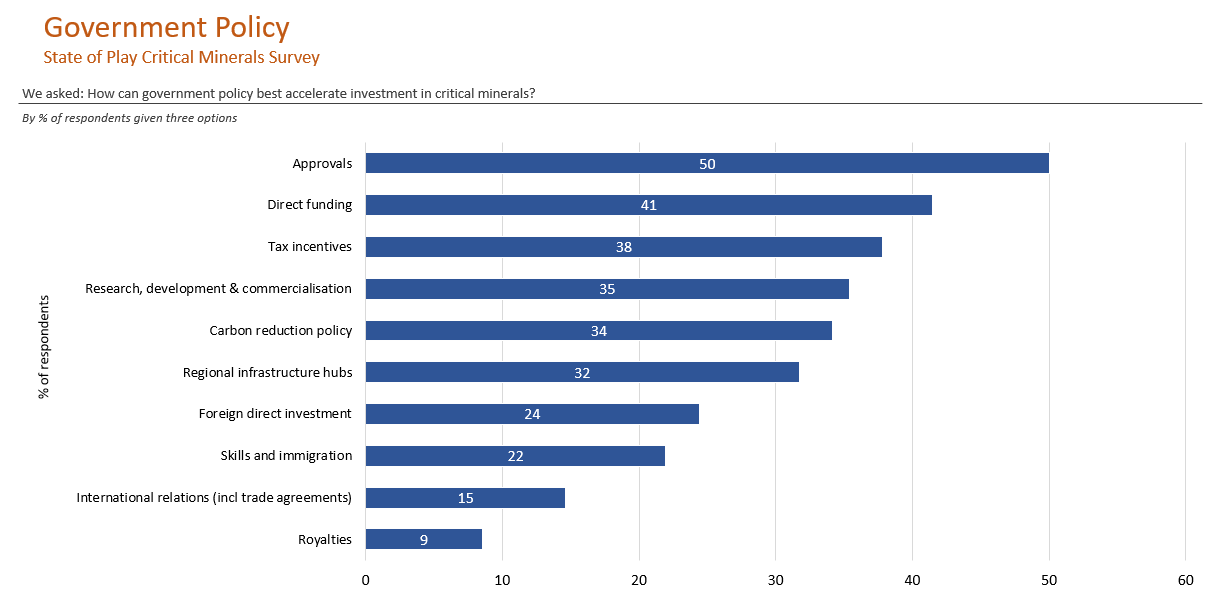

In the latest State of Play Critical Minerals survey, industry leaders agree that government policies, including direct funding, and research, development and commercialisation will best accelerate investment into the critical minerals industry, along with streamlined approvals and tax incentives.

There are examples around the world of government grants and other policies designed to incentivise the development of a battery recycling industry. Most notably, the US launched its Battery Manufacturing and Recycling Grants Program in 2022, which provides US$3 billion towards domestic manufacturing and recycling capabilities.

Innovation

At the heart of every new industry is innovation. With the development of the battery recycling industry, a new ecosystem of service-based companies will emerge to work alongside recyclers, including those that specialise in transportation and storage of heavy and potentially hazardous EV and stationary storage batteries.

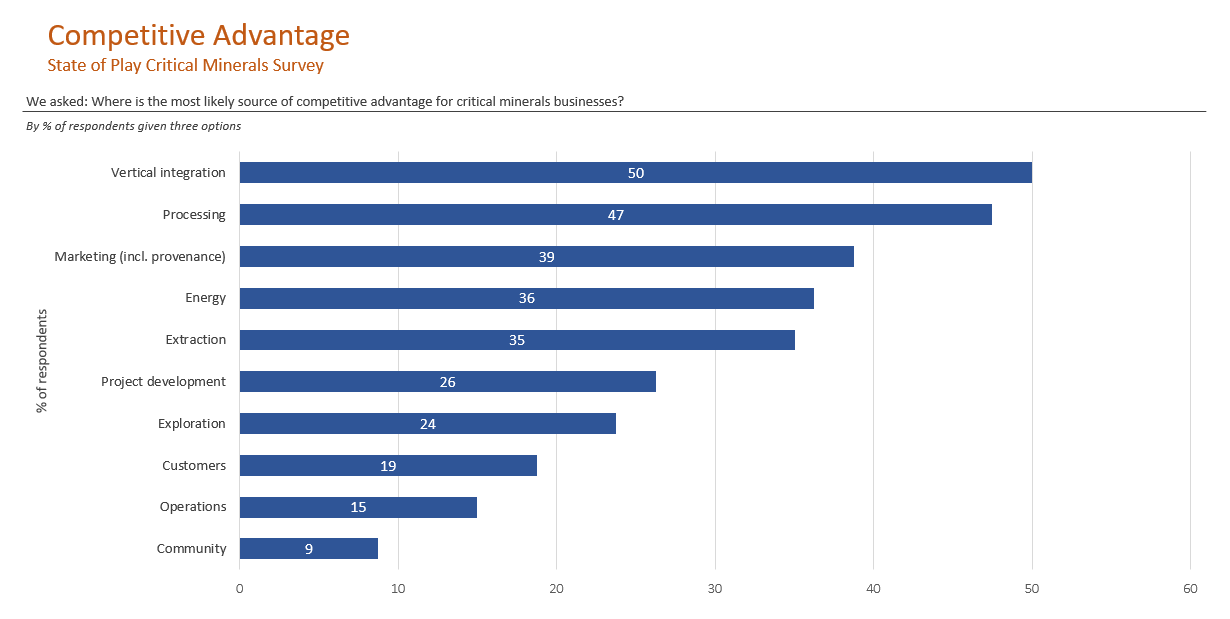

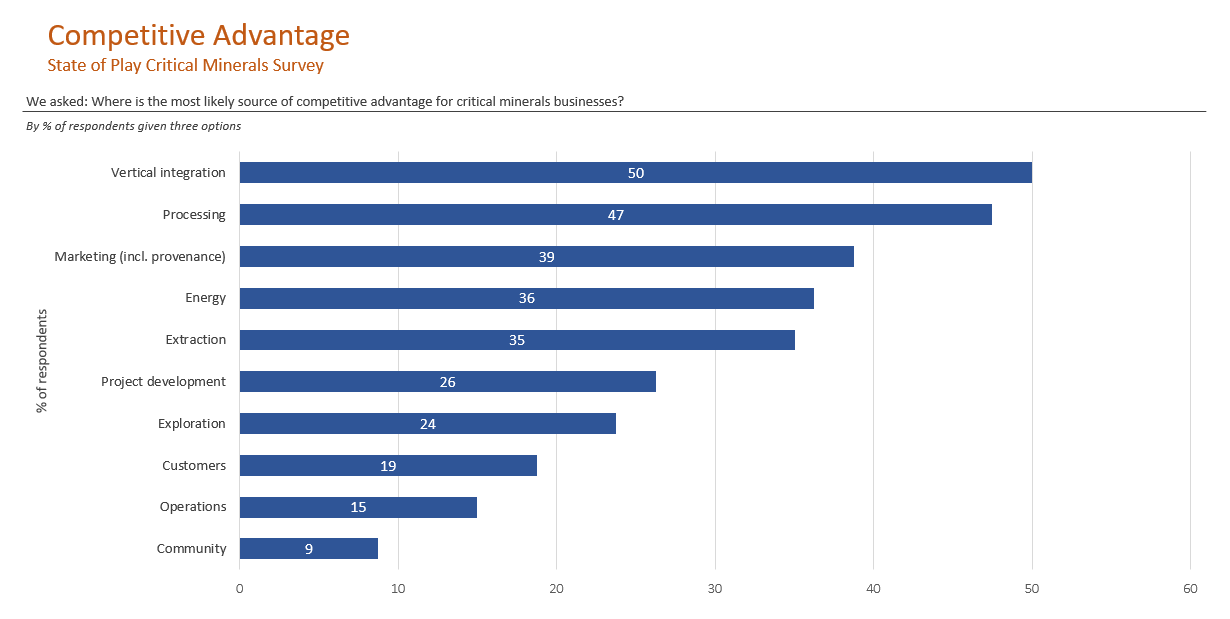

New service models could emerge in a number of ways. Recycling could be integrated into companies’ value chains, essentially involving them in every steps of downstream processing, including recycling. In our recent State of Play Critical Minerals survey, 50% of respondents said vertical integration is a likely source of competitive advantage for critical minerals businesses.

Partnerships, bringing together experts along the value chain, may be created to work towards a joint goal of recycling. A recent example is the consortium formed by Veolia, Groupe Renault and Solvay who are combining their expertise to recycle the metals in electric vehicle batteries in a closed loop. Companies may also choose to recycle in house, maintaining battery material ownership and reaping the benefits that come with this.

So now what?

Establishing a viable battery recycling industry in Australia poses various challenges, but its success would bring significant economic and social benefits to the country.

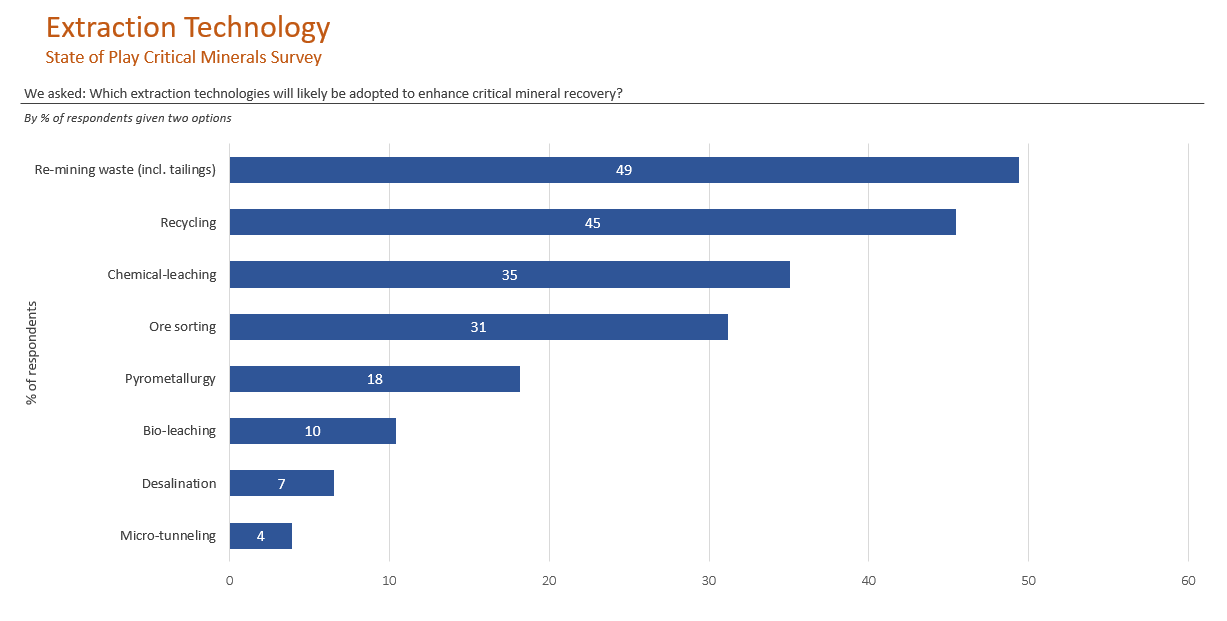

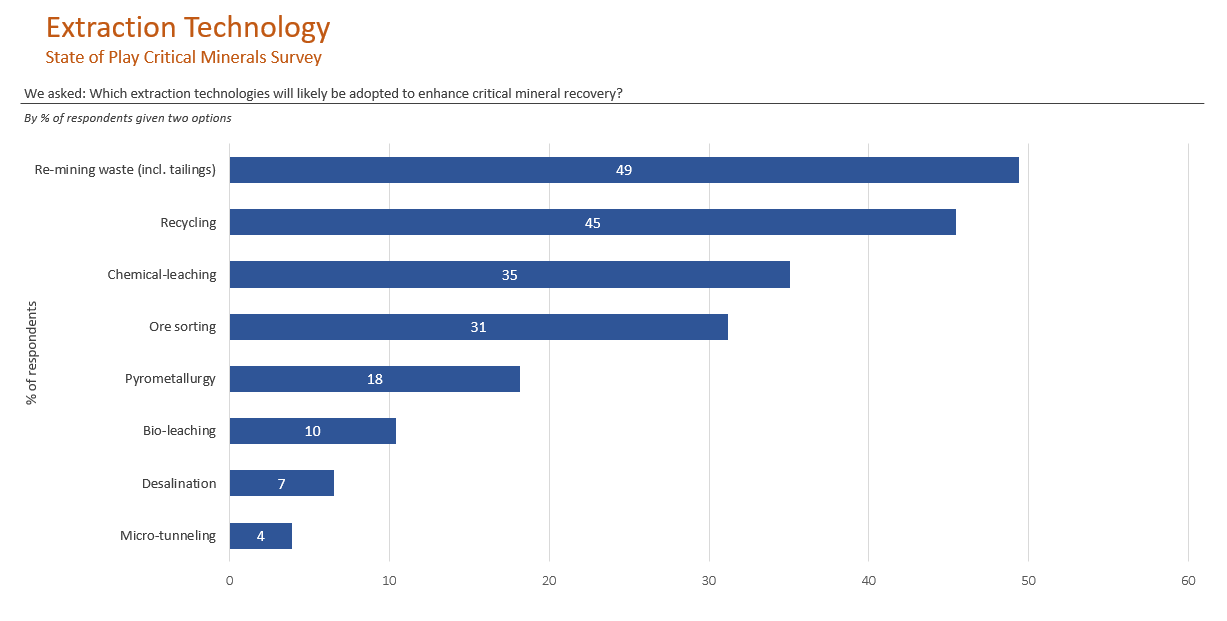

Not only will it create a secondary market for both minerals and batteries, but it will also establish Australia as a major player in the critical mineral supply chain. The broader industry is aware of the benefits of enhancing recycling technologies, with 45% of respondents stating in our recent Critical Minerals survey that recycling will likely be adopted to enhance critical mineral recovery.

As the world works towards the goal of net zero by 2050, there will be increasing regulatory and ESG pressures that companies will have to accommodate. The EU, for example, has mandated that automotive OEMs to take back vehicle owners’ end-of-life batteries through its End-of-Life Vehicles Directive, while the US have seen a recent rise in recommendations from recycling advisory groups that are predicted to include regulatory measures towards further battery recycling. Australia will need to be cognisant of these increasing pressures to avoid being left behind, but also so it can capitalise on the economic opportunity a domestic battery recycling industry poses.